401k tax bracket calculator

The more income a taxpayer makes the higher the marginal tax bracket. The tax benefits of 401ks are like the triple-crown of finances.

Tax Calculator Tax Preparation Tax Brackets Income Tax

Start your 401K investment in 1 year.

. For example tax-advantaged accounts like a 401k traditional IRA solo 401K or SEP IRA allow your investments to grow tax-deferred. The division of retirement accounts are typically one of the most complex issues in divorce cases. Start your 401K investment now.

The other major advantage of a 401k plan is the tax savings from pre-tax contributions. There are some slight changes but nothing major like we saw from 2017 to 2018 with the Trump Tax Cuts and Jobs Act. Using this 401k early withdrawal calculator is easy.

If youre already earning a normal salary your early withdrawal could easily push you into a higher tax bracket and still come with that additional penalty making it a very pricey withdrawal. So if you took 20000 from your 401k and that puts you in the 22 tax bracket you may only get about 1200013000 depending on state income tax when all is said and done. Heres an overview of how 401k taxes work how a 401k can affect your tax return and how to pay less tax when the IRS asks for a cut of your retirement savings.

So lets say this person also locked in a 100000 investment gain held over a year. If the taxpayer has included the excess contribution on his or her tax return there is no need to complete an amended return and the Form 1099-R received in the current year can be ignored. This capital gain starts and stays within the 15 tax bracket.

Lets take a look at some tax-equivalent yield examples. First contributions are pre-tax. The table below shows the tax bracketrate for each income level.

That could put your tax rate in the top 37 bracket. A Roth 401k is an employer-sponsored retirement plan thats funded by after-tax dollars. There are tax implications and unique rules and laws that apply.

The bottom line is that all the tax bracket upper limits went up a little bit. The calculator below can help estimate the financial impact of filing a joint tax return as a married couple as opposed to filing separately as singles based on 2022 federal income tax brackets and data specific to the United States. A 401k early withdrawal means a tax penalty of 10 percent on your withdrawal which is on top of the normal income tax assessed on the money.

This would then start other long-term capital gains in the 15 tax bracket. From there it is a simple subtraction problem to figure out that you paid 61 cents in sales tax. A Roth 401k is an account funded with after-tax contributions.

This allows owners to pay less in self-employment taxes and contribute pre-tax dollars to 401k and health insurance premiums. Please visit our 401K Calculator for more information about 401ks. Funds are essentially allowed to grow tax-free until distributed.

At the earliest this is age 59½ Second your 401k contributions are not counted as income which could put you in a lower tax bracket. Employer matching program contributions are made using pre-tax dollars. 401k tax breaks.

Use our 401k calculator to. The charts below show the potential tax. For this example we will enter 72 as the age.

Tax Equivalent Yield vs Rate of Return - This bar chart is a comparison between the tax free rate of return versus the equivalent return needed in a taxable investment. As noted above its vital to know your marginal tax rate. Its property taxes are also below average when compared to other states.

For instance each tax bracket will produce a different tax-equivalent yield. This 401k distribution calculator is very simple and all it asks is that you enter your account balance at the end of the last year. If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737.

While the state income taxes deal a heavy hit to some earners paychecks Oregons tax system isnt all bad news for your wallet. The calculator also asks you what your age was at the end of the last calendar year. For example lets say a person earned 50000 in taxable income.

55 or older If you left your employer in or after the year in which you turned 55 you are not subject to the 10 additional tax. Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax rate and your expected annual rate of return. Only distributions are taxed as ordinary income in retirement during which retirees most likely fall within a lower tax bracket.

Using our retirement calculator. You dont pay taxes on the money until you withdraw it when you retire. Marriage has significant financial implications for the individuals involved including its impact on taxation.

So the tax comes in at 15000. In most instances you wont incur capital gains taxes. Say your marginal tax rate is 22.

And because 401ks are funded with before-tax dollars youll still have to pay taxes on anything you take out even after the age of 59 ½. For 2019 the Federal tax brackets are very similar to what you saw in 2018. Use our S Corp Tax Calculator to calculate your S corp vs LLC tax savings and decide if an S corp makes.

State and FICA taxes based on the individual owners tax bracket and filing status. F or 2021 the LTD tax rate is 00067. For example a divorce is a rare time that allows you early access to your 401k or IRA without a tax penalty if your spouse is awarded part of your account.

As an example we will enter 100000 as the account balance. The amount you pay is based on your tax bracket and if youre younger than 59½ add a 10 early withdrawal penalty in most cases. If you know youll be receiving a Form 1099-R next year with a Code P and want to avoid the need to amend a return include the data in the tax return in.

Marginal Tax Rate - The tax bracket the user is currently in. Traditional 401ks allow pre-tax contributions. It shares certain similarities with a traditional 401k and a Roth IRA although there are important.

One of Oregons redeeming tax qualities is its absence of state or local sales taxes. Tax Equivalent Yield - The return needed in a taxable account to equal the rate of return in a tax free account. Estimate your marginal state income tax rate your tax bracket based on your current earnings including the amount of the cash withdrawal from your retirement plan.

With a click of a button you can easily spot the difference presented in two scenarios.

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

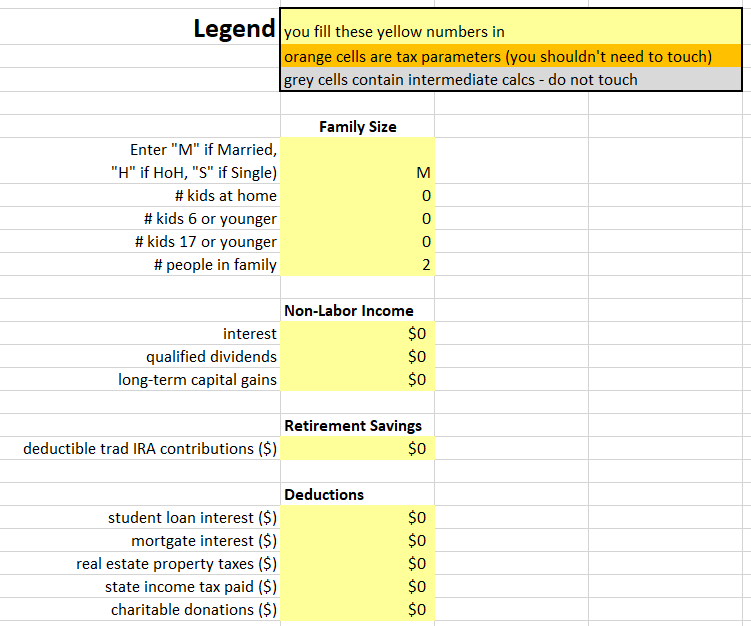

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Capital Gains Tax Calculator 2022 Casaplorer

2021 Tax Calculator Frugal Professor

Net To Gross Calculator

Tax Calculator Estimate Your Income Tax For 2022 Free

What Are Marriage Penalties And Bonuses Tax Policy Center

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Cryptocurrency Tax Calculator Forbes Advisor

Sales Tax Calculator

Tax Calculator Calculator Design Calculator Web Design

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

Self Employed Tax Calculator Business Tax Self Employment Self

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Understanding Tax Brackets Interactive Income Tax Visualization And Calculator Engaging Data

2021 Tax Calculator Frugal Professor