Ira minimum withdrawal calculator

If you are planning your retirement and you find yourself asking How can I avoid paying taxes on my IRA withdrawal when I retire plan ahead and open a Roth IRA instead of a traditional IRA. Once you reach age 59½ you can withdraw funds from your Traditional IRA without restrictions or penalties.

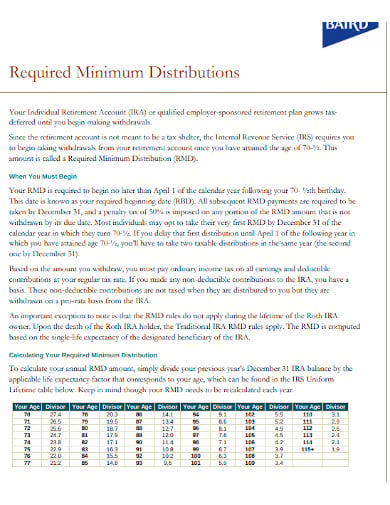

Required Minimum Distribution Calculator

In some situations the RMD rules for beneficiaries of IRA owners who died before 2020 are different than the RMD rules for beneficiaries of IRA owners who dies in 2020 and beyond.

. Instead wait until RMDs are due or if you got the IRA from a non-spouse stretch withdrawals over 10 years. Minimum holding periodTax-free withdrawals on earnings in retirement cannot be made unless funds in the account have been held for at least five years though this only applies to people. IRA Required Minimum Distribution Worksheet Use this worksheet to figure this years required withdrawal for your traditional IRA UNLESS your spouse1 is the sole beneficiary of your IRA and he or she is more than 10 years younger than you.

Exceptions to the Early Withdrawal Penalty. Individuals will have to pay income taxes on withdrawals though you can split the tax payment across up to 3 years. Before making a Roth IRA withdrawal keep in mind the following guidelines to avoid a potential 10 early withdrawal penalty.

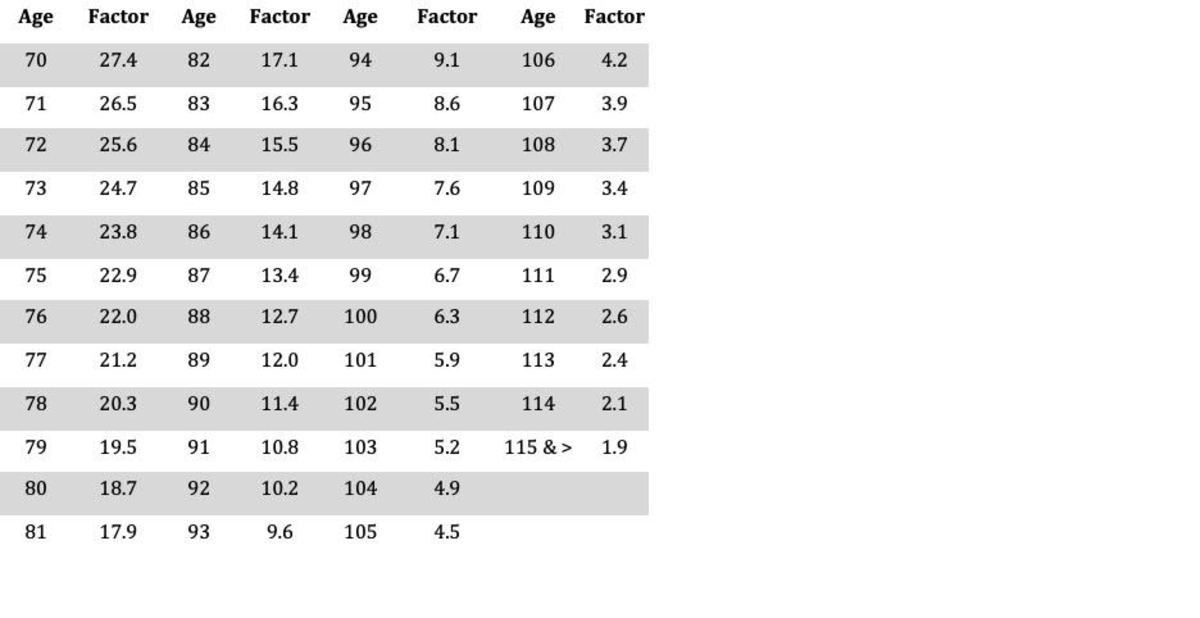

Distributions from Individual Retirement Arrangements IRAs Page 36. While you still have to pay taxes on any money taken out of a 401k or IRA before a certain age there are some circumstances that would let you get around the 10 early withdrawal penalty for retirement funds. To determine the minimum amount the IRA balance is divided by the distribution period.

Helps IRA beneficiaries calculate the required minimum distribution RMD amount that must be withdrawn this calendar year from an inherited IRA if applicable. 401K and other retirement plans. Ready to run some numbers.

You can make a penalty-free withdrawal at any time during this period but if you had contributed pre-tax dollars to your Traditional IRA remember that your deductible contributions and earnings including dividends interest and capital gains will be taxed as ordinary income. With the life expectancy payment option a minimum amount must be withdrawn each year. Please ensure that youre referring to the most current tables when calculating your RMD which can be found here under Calculating and taking your RMD or refer to the updated Single Life.

Withdrawals must be taken after a five-year holding period. The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus. To determine what your withdrawal options might be select the Identify Beneficiary Options button below.

Exceptions for Both 401k and IRA. Inherited IRA Tax Strategies. One inherited IRA tax management tip is to avoid immediately withdrawing a single lump sum from the IRA.

If you return the cash to your IRA within 3 years you will not owe the tax payment. The IRS implemented new Life Expectancy Tables on January 1 2022 for use in calculating required minimum distributions from accounts that qualify. Use this calculator to determine your required minimum distributions RMD from a traditional IRAThe SECURE Act of 2019 raised the age for taking RMDs from 70 ½ to 72 for those born after July 1.

Compare Investments and Savings Accounts INVESTMENTS. Roth IRA and Traditional IRA. Retirement Plan and IRA Required Minimum Distributions FAQs Internal Revenue Service.

RMDs are taxable and can change your tax bracket and increase your overall tax burden. Use this calculator to determine your Required Minimum Distributions RMD as a beneficiary of a retirement account. Concerning Roth IRAs five years or older tax-free and penalty-free withdrawal on earnings can occur after the age of 59 ½.

A beneficiary may always withdraw an additional amount including a lump-sum distribution. The life expectancy payment is the minimum amount that must be withdrawn. Withdrawals must be taken after age 59½.

How much you will pay in taxes when you withdraw money from an individual retirement account IRA depends on the type of IRA your age and even the purpose of the withdrawal. You die or become permanently disabled. The CARES Act passed in March of 2020 temporarily waived required minimum distributions RMDs for all types of retirement plans including IRAs 401ks 403bs 457bs and inherited IRA plans for calendar year 2020.

A traditional IRA is funded with your pre-tax dollars and you pay taxes when you withdraw the funds. Start here with the Inherited IRA calculator or if applicable jump to the Traditional IRA calculator. Roth IRA withdrawal and penalty rules vary depending on your age and how long youve had the account and other factors.

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Ira Rmd Calculator Ira Owners 70 1 2 72 Secure Act And Older

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

New Tables Are Available For Calculating Required Minimum Distributions Rmds In 2022 Julie Jason

How Recent Changes To Required Minimum Distribution Rules May Affect Future Value Tsp Accounts

Required Distributions On Inherited Retirement Accounts Reduced In 2022 Putnam Wealth Management

Ira Required Minimum Distribution Table Sound Retirement Planning

Required Minimum Distribution Calculator Estimate Minimum Amount

Ira Future Withdrawal Calculator Forecast Rmds Through Age 113

Calculating The Required Minimum Distribution From Inherited Iras Morningstar

Rmd Table Rules Requirements By Account Type

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

Ira Withdrawal Calculator Online 56 Off Www Ingeniovirtual Com

Rmd Table Rules Requirements By Account Type

Ira Withdrawal Calculator Online 56 Off Www Ingeniovirtual Com

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

Retirement Withdrawal Calculator For Excel