22+ 2nd mortgage vs heloc

As the name implies a second. The average 30-year fixed-refinance rate is 693 percent down 19 basis points compared with a week ago.

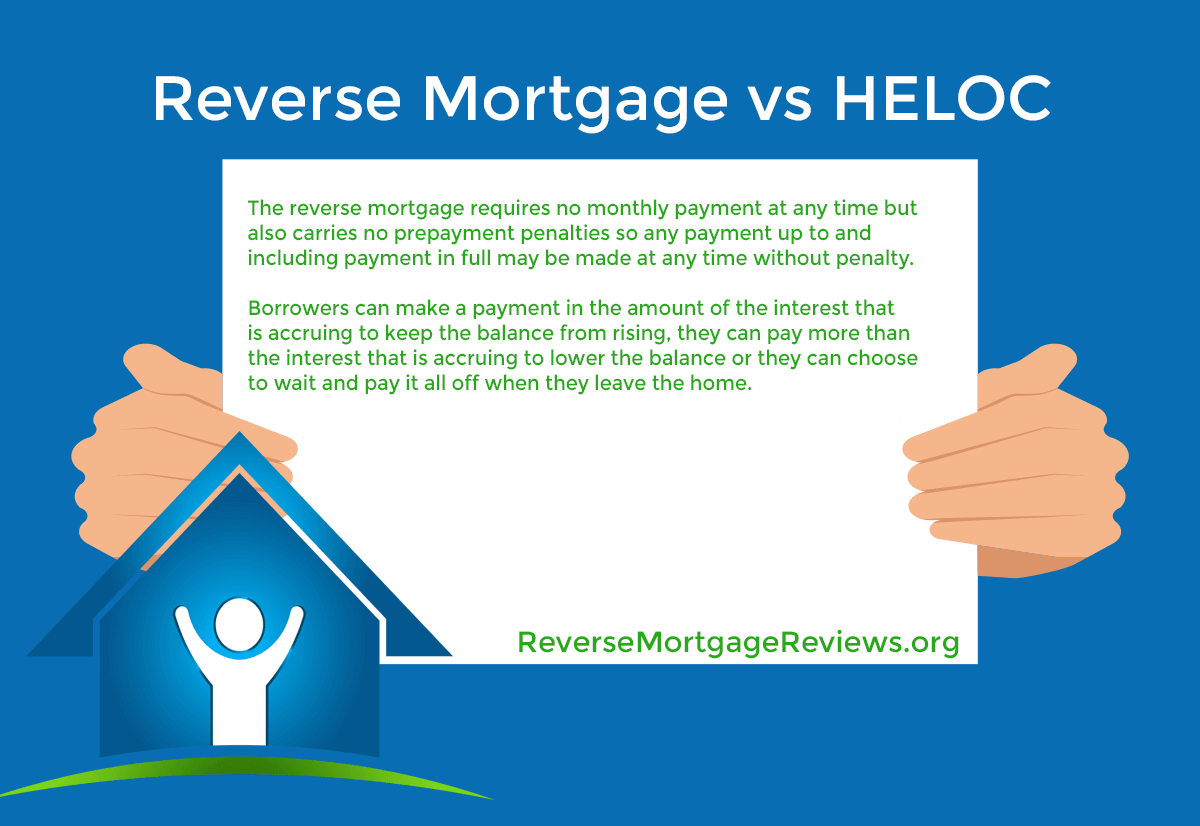

Hecm Vs Heloc Loan Comparison Which Is Best For You Reversemortgagereviews Org

Get Easily Approved For a Second Mortgage.

. Top Lenders Reviewed By Industry Experts. Put Your Home Equity To Work Pay For Big Expenses. Web The average 30-year fixed-refinance rate is 697 percent down 11 basis points over the last week.

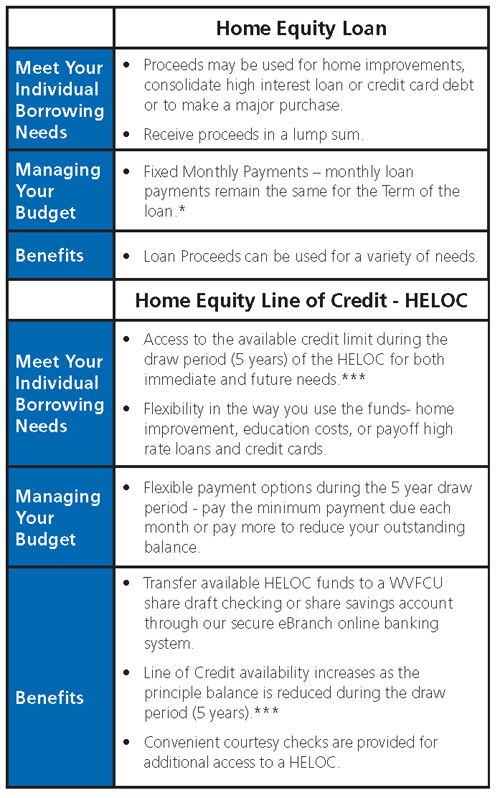

Ad Use Our Comparison Site Find Out Which Lender Suits You The Best. Web The main benefit is that you can use the funds as you need them. Web As with a home equity loan a HELOC typically allows you to borrow up to 85 of your home equity.

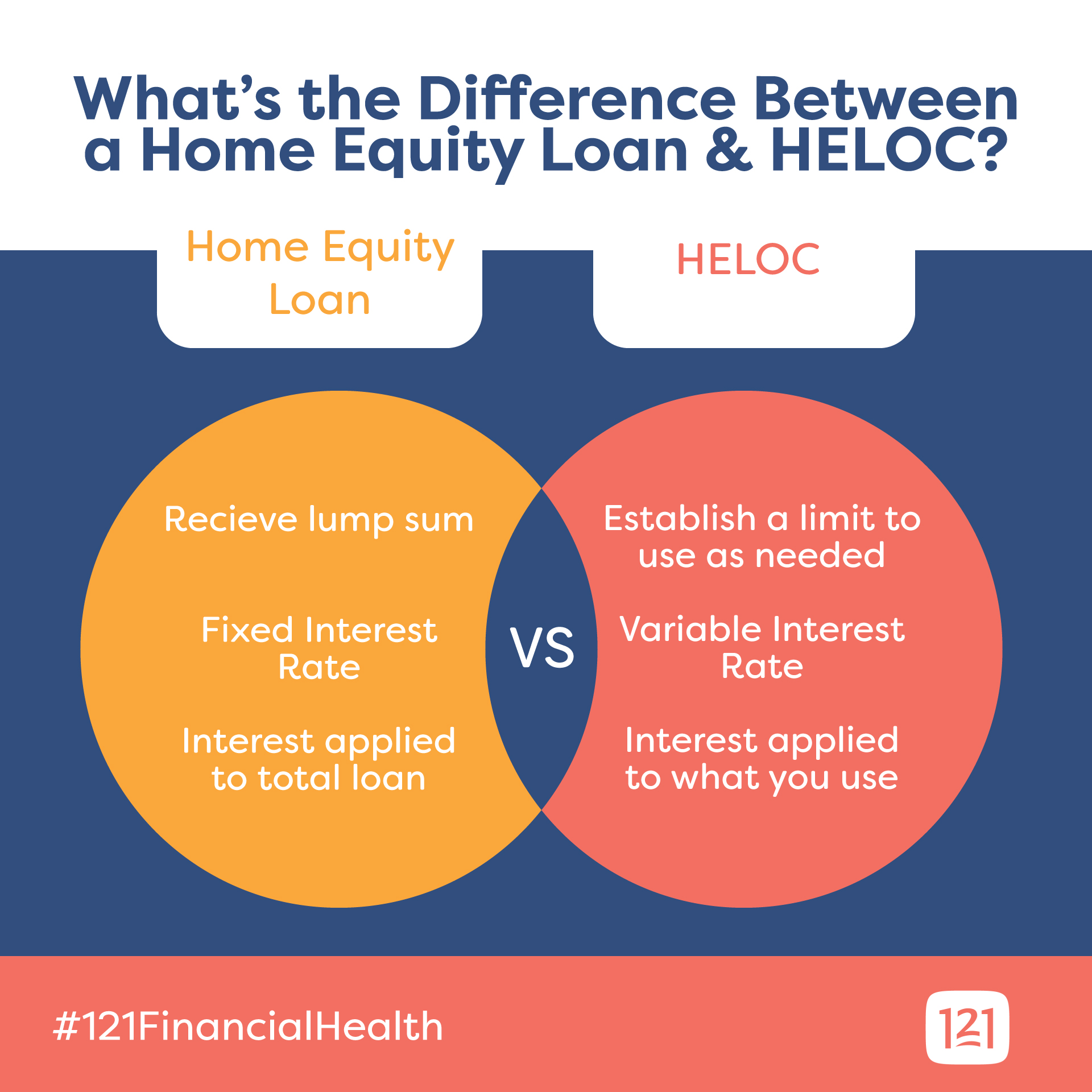

Apply Get Fast Pre Approval. Web 10-year HELOC Rates. Web A HELOC is a line of credit so you can decide how much to borrow over time while a second mortgage is a one-time loan.

Apply Online Get Pre Approved In 24hrs. Ad Use Your Home Equity Get a Loan With Low Interest Rates. A HELOC however has a variable interest rate which means.

Check Out the Best Lenders. Apply Online Get Pre Approved In 24hrs. Web A home equity loan also called a second mortgage or a home equity line of credit HELOC are two popular options.

If the most recent. Ad Save Time and Choose the Right Home Equity Offer for You. Compare Mortgage Refinance Options Today.

Apply for a Home Loan Today. Skip The Bank Save. Web Most HELOCs are effectively free or very low cost while 2nd mortgages always come with substantial points and fees that can easily add up to several thousand.

Make Sure You Dont Overpay for Your Home Loan. Compare Mortgage Refinance Options Today. Web Since a HELOC is a second mortgage or in the second lien position the HELOC lender might be paid less or not at all after a foreclosure.

Ad Todays 10 Best Home Equity Line of Credit Lenders. Web Mortgages and home equity loans are both forms of borrowing that use your home as collateral. 5 Best HELOC Loans Compared Reviewed.

A home equity line of credit HELOC and a second mortgage home equity loan. Web Refinanced mortgages and second mortgages both require you to pay interest on a lump sum. Web Mortgage alternatives to a HELOC Second mortgage A HELOC is one type of second mortgage.

Both are types of financing secured by the. Ad Opt for Fixed Rates and Monthly Payments Instead of a HELOC. You then make fixed-rate payments on that.

Web While more expensive than other mortgages second mortgages generally have lower rates than credit cards or personal loans so they can still be used to. Make Sure You Dont Overpay for Your Home Loan. A HELOC can make.

Apply Before Rates Increase. Ad Save Time and Choose the Right Home Equity Offer for You. A month ago the average rate on a 30-year fixed refinance.

A second mortgage loan is paid to you in a lump sum at the start of the loan. Mortgages are used by prospective buyers to fund the purchase of a. Web Second mortgages tend to have higher interest rates than first mortgages for that reason.

Why Not Borrow from Yourself. Web A home equity loan is a common type of second mortgage that allows you to borrow money against the equity youve built up in your home. The 2nd property usually needs.

Another is a home equity loan. With a HELOC you only pay interest on the amount you spend. Leverage the Equity of Your Home with the Help of Discover.

Web The difference essentially is the language because your second mortgage will be processed as either a home equity loan or line of credit HELOC. The repayment period for a second. Skip The Bank Save.

Web There are two main ways to tap into the equity built up in your home. Also Get Your Funds Upfront. Ad Use Our Comparison Site Find Out Which Lender Suits You The Best.

Find The Best Home Equity Line of Credit Rates. Web People use the HELOC to purchase a 2nd property because it allows them to purchase a 2nd property without actually having the down payment. Check Out the Best Lenders.

Get Competitive Quotes From Top Lenders. Web Unlike a HELOC which allows you to draw out money as you need it a second mortgage pays you one lump sum. Ad Now That Rates Have Dropped on November 10th See About Tapping Into Your Home Equity.

5 Best HELOC Loans Compared Reviewed. Web Current 30 year mortgage refinance rate dips --019. This week the average interest rate on a 10-year HELOC is 736 downa bit from 739 the previous week and 757 the high over the.

The interest rate on a second mortgage is often higher than the rate on a first mortgage which means you will end up paying more in interest over the life of the loan. A borrower who now has two mortgage payments to make instead of one.

:max_bytes(150000):strip_icc()/what-is-home-equity-315663-FINAL-5bbe03efc9e77c0026be1d5a.png)

Heloc Vs Second Mortgage What S The Difference

Mortgage Loans Vs Home Equity Loans What You Need To Know

Mortgage Broker Home Loan Mortgage Specialist 1st Choice Mortgage Boise Meridian Nampa Caldwell

How Do Home Equity Loans Work And When To Use Them

West Virginia Federal Credit Union Home Equity Loans West Virginia Fcu

Should You Do A Heloc Or A 2nd Mortgage Comparison Pros Cons

Home Equity Loan Vs Heloc To Fund Home Improvements

Second Mortgage Vs Heloc What S The Difference Westchester Mortgage

Heloc Or Second Mortgage Which Is Better

Kubik Mortgage Group Custom Mortgage Solutions Calgary Alberta

9900 Se 222nd Dr Damascus Or 97089 Mls 22341140 Zillow

Cash Out Vs Heloc Vs Home Equity Loan Which Is The Best Option Right Now And Why

Heloc Vs Home Equity Loan Compare Pros And Cons

Heloc Vs Second Mortgage Which One Is Best Point2 News

Kubik Mortgage Group Custom Mortgage Solutions Calgary Alberta

Heloc Vs Second Mortgage Which Is Right For You Britannica Money

Second Mortgage Vs Home Equity Loan Moneytips